elaspoletf.ru

Community

Best Stocks Below 5 Dollars

The best cheap stocks to buy ; Amcor (AMCR), $, ; Arcadium Lithium (ALTM), $, ; Kosmos Energy (KOS), $, ; Valley National Bancorp (VLY). RobinHood Penny Stocks - Find stocks under $5 on RH. Penny stocks available to trade in the RobinHood mobile stock trading app. Browse top penny stock. Looking for the best stocks under $5 to buy in ? MarketBeat has identified 25 low-priced stocks that you should consider for your portfolio. stocks -- stocks with share prices of less than $5 -- can be a tempting way to try to grow your money quickly. However, penny stocks generally have a well. Looking for good, low-priced stocks to buy? Every day, the financial experts at Benzinga identify the best stocks to buy now under $5. Derived from the 50 most active stocks priced under $5 listed on the NSD exchange. The default setting shows stocks ranging from $ to $ Stocks Under $10 · Avalo Therapeutics Inc AVTX. Price: $ Daily change: N/A. Percent change · SmartKem Inc SMTK. Price: $ Daily change: N/A · Aurora Mobile. Short selling can be very risky for both the investor and the broker. Brokers will often tell investors that only stocks above $5 can be sold short. Cheap Stocks To Buy And Watch: Silvercorp Busts Through This Trendline Entry · Lichen China (LICN) · CPI Aerostructures (CVU) · Idaho Strategic Resources (IDR). The best cheap stocks to buy ; Amcor (AMCR), $, ; Arcadium Lithium (ALTM), $, ; Kosmos Energy (KOS), $, ; Valley National Bancorp (VLY). RobinHood Penny Stocks - Find stocks under $5 on RH. Penny stocks available to trade in the RobinHood mobile stock trading app. Browse top penny stock. Looking for the best stocks under $5 to buy in ? MarketBeat has identified 25 low-priced stocks that you should consider for your portfolio. stocks -- stocks with share prices of less than $5 -- can be a tempting way to try to grow your money quickly. However, penny stocks generally have a well. Looking for good, low-priced stocks to buy? Every day, the financial experts at Benzinga identify the best stocks to buy now under $5. Derived from the 50 most active stocks priced under $5 listed on the NSD exchange. The default setting shows stocks ranging from $ to $ Stocks Under $10 · Avalo Therapeutics Inc AVTX. Price: $ Daily change: N/A. Percent change · SmartKem Inc SMTK. Price: $ Daily change: N/A · Aurora Mobile. Short selling can be very risky for both the investor and the broker. Brokers will often tell investors that only stocks above $5 can be sold short. Cheap Stocks To Buy And Watch: Silvercorp Busts Through This Trendline Entry · Lichen China (LICN) · CPI Aerostructures (CVU) · Idaho Strategic Resources (IDR).

Best Stocks Under 5 ; ETON, ; LFCR, ; MMT, ; OB, 10 Best Stocks Under 5 Dollars to Buy Right Now · Digital Turbine (APPS) ran from about $ to a high of $ for 8,%. · Harmonic (HLIT) ran from $ This helps build good investment fundamentals because they focus on company performance more-so than fluctuations in the daily stock price. With that said, here. Penny stocks — US stocks ; KXIN · D · USD, +% ; LUXH · D · USD, +% ; BNZI · D · USD, +% ; MAXN · D · USD, −%. Top Stocks Under $5 include Chesapeake Energy, Zynga, and Groupon, the online deal site made famous from socialization of coupons. Stocks Under $10 ; Avalo Therapeutics Inc AVTX · $ ; Tenon Medical Inc TNON · $ ; SmartKem Inc SMTK · $ ; Aurora Mobile Ltd - ADR JG · $ ; Vaccinex Inc. A penny stock refers to a small company's stock that typically trades for less than $5 per share. Although some penny stocks trade on large exchanges such as. Best stocks under $10 to buy · SoFi Technologies (SOFI) · BGC (BGC) · ImmunityBio (IBRX) · Marqeta (MQ) · Geron (GERN) · Iovance Biotherapeutics (IOVA). Stock Price. Stock Price. September 13, p.m. ET. The stock Jul 5. Aug 2. Sep XNAS:AAPL,NASDAQ:AAPL historical. Upgrade to Unlock Every Stock Score. Upgrade to Premium. Best Stocks Under. 75 50 35 20 10 5 2 1. Market Cap [$Bn]. 0 B 1T+. 10B. 1T+. Sector. (all). In this article, we'll take a look at some of the best stocks under $5 that you can invest in right now. This screen filters out low liquidity stocks with "last 22 day average trading volume > 5m" and targets profitable companies with "net income > 0" for. On Yahoo Finance goto most active small cap stocks list. Has 30 on there and ~20 have options. Most are under $10/share. Cheap Dividends Stocks Under $5 · VAALCO Energy, Inc. · Sirius XM Holdings Inc (NASDAQ: SIRI) – Dividend Yield – % · Nordic American Tanker Ltd (NYSE: NAT) –. Looking to invest in AI and machine learning stocks but don't want to spend more than $5? Here are six of the best AI stocks under $5 that are worth a look. Short selling can be very risky for both the investor and the broker. Brokers will often tell investors that only stocks above $5 can be sold short. Best Penny Stocks Under 5 Cents Right Now ; #1 - Loop Media. NYSEAMERICAN:LPTV · $ (-$). P/E Ratio: Market Cap: $ million · million shares. Stocks $5 or under are referred to as penny stocks, and they are definitely riskier and more volatile than higher-priced stocks. It's possible. Package Name: Stocks Under $5. Recommended Positions: Long Forecast Length: 3 Months (6/11/24 - 9/11/24) I Know First Average: %. A penny stock, also known as an OTC or Over-The-Counter stock, typically references a stock that trades for less than $5 per share. Penny stocks are often.

How Does Margin Trading Work

Margin trading, a stock market feature, allows investors to purchase more stocks than they can afford. Investors can earn high returns by buying stocks at the. How Does Margin Trading Work? In margin trading, users borrow money from the exchange to trade bigger positions. When trader Jason wants to open a margin trade. A margin account lets you leverage securities you already own as collateral for a loan to buy additional securities. Here's an example: Suppose you use. Margin is a loan from Wells Fargo Advisors collateralized by eligible stocks, mutual funds, bonds, and other securities in your Wells Fargo Advisors brokerage. What is margin trading? Buying stocks on margin is essentially borrowing money from your broker to buy securities. That leverages your potential returns, both. Your buying power consists of your money available to trade in your account, plus the amount that can be borrowed against securities held in your margin account. When trading on margin, an investor borrows a portion of the funds they use to buy stocks to try to take advantage of opportunities in the market. The investor. While a primary benefit of margin trading may be increased buying power, investors could lose more money than they initially invested. Unlike a cash account. Here's how the margin account works. You have a cash balance and they give you a couple times you cash as buying power. Let's say the account. Margin trading, a stock market feature, allows investors to purchase more stocks than they can afford. Investors can earn high returns by buying stocks at the. How Does Margin Trading Work? In margin trading, users borrow money from the exchange to trade bigger positions. When trader Jason wants to open a margin trade. A margin account lets you leverage securities you already own as collateral for a loan to buy additional securities. Here's an example: Suppose you use. Margin is a loan from Wells Fargo Advisors collateralized by eligible stocks, mutual funds, bonds, and other securities in your Wells Fargo Advisors brokerage. What is margin trading? Buying stocks on margin is essentially borrowing money from your broker to buy securities. That leverages your potential returns, both. Your buying power consists of your money available to trade in your account, plus the amount that can be borrowed against securities held in your margin account. When trading on margin, an investor borrows a portion of the funds they use to buy stocks to try to take advantage of opportunities in the market. The investor. While a primary benefit of margin trading may be increased buying power, investors could lose more money than they initially invested. Unlike a cash account. Here's how the margin account works. You have a cash balance and they give you a couple times you cash as buying power. Let's say the account.

How does margin trading work? Margin trading means that traders only need to put down a deposit to open a position, which gives traders more buying power and. How margin trading works Once Margin Trading Facility (MTF) account is opened, the broker can disburse funds in it which the investor can use to buy shares. Using margin to purchase securities through your brokerage account is effectively like using the current cash or securities already in your. Trade on margin is a way to multiply the funds involved in a transaction at the expense of your broker's funds but also you should alway remember that margin. Buying on margin is the purchase of an asset by paying the margin and borrowing the balance from a bank or broker. How to calculate margin The margin needed to open each trade is derived from the leverage limit associated with the instrument that you wish to trade. For. What is margin trading and how does it work? You'll first need to sign a margin agreement and set up a margin trading account with your brokerage. This is. Margin trading allows an investor to buy more securities than you could with your own capital alone. Trading “on margin” means you're investing with money you. A “margin account” is a type of brokerage account in which the broker-dealer lends the investor cash, using the account as collateral, to purchase securities. You also pay margin interest on the loan. With short selling, you borrow securities from your brokerage to sell them for a profit when the value of a stock goes. How does margin trading work on stocks? To buy stocks on margin, you need to open a margin account first. Then you need to get approval for the loan. There are two margin definitions. The term Securities margin refers to borrowing money to purchase stock. However, commodities margin involves putting in your. When you use margin, you are given leverage for your trading, which goes together with margin trading; you'll see this expressed as a ratio like , , or. You can lose more funds than you deposit in the margin account. · We can force the sale of securities in your account(s). · We can sell your securities without. Margin trading entails greater risk, including, but not limited to, risk of loss and incurrence of margin interest debt, and is not suitable for all. In conclusion, margin trading can offer great potential rewards to traders who know how to manage their risk and catch price movements. However, a trader has to. Buying on margin is borrowing money from a broker to purchase stock. You can think of it as a loan from your brokerage. Margin trading allows you to buy. When you choose to buy on margin, you simply put the money toward the securities you want. You can see how much buying power you have for stocks and options in. Margin trading is when you pay only a certain percentage, or margin, of your investment cost, while borrowing the rest of the money you need from your broker.

Insurance For Dog Breeders

Cats and dogs that are intentionally bred can be covered for illnesses and injuries related to breeding, whelping, and queening if you add our Breeding Rider to. ✓ With British Pet Insurance's breeder partner program, our introductory insurance cover is completely free of charge for you and your customers, ensuring your. Trupanion's Breeder Support Program helps responsible breeders send puppies and kittens to new homes with access to quality medical coverage. You can get 4 weeks free pet insurance through Petplan breeders We have been working with breeders for over 40 years to provide 4 weeks free insurance to. Business Insurance for Dog Breeders Good Dog is on a mission to educate the public, support dog breeders, and promote canine health so we can give our dogs. We arrange dog breeders insurance that gives you peace of mind to focus on the job at hand. We understand the exposures you face daily and the covers you need. The core of the program is the Go Home Day Offer, which lets breeders provide their buyers with a special Trupanion offer for 30 days of insurance coverage. Breeder's insurance is a kind of insurance that can cover costs related to a breeding dog's or cat's pregnancy, delivery, nursing, or other qualifying medical. The new package provides breeders with coverage not only for their breeding operations, but also for activities such as dog day care and pet sitting, boarding. Cats and dogs that are intentionally bred can be covered for illnesses and injuries related to breeding, whelping, and queening if you add our Breeding Rider to. ✓ With British Pet Insurance's breeder partner program, our introductory insurance cover is completely free of charge for you and your customers, ensuring your. Trupanion's Breeder Support Program helps responsible breeders send puppies and kittens to new homes with access to quality medical coverage. You can get 4 weeks free pet insurance through Petplan breeders We have been working with breeders for over 40 years to provide 4 weeks free insurance to. Business Insurance for Dog Breeders Good Dog is on a mission to educate the public, support dog breeders, and promote canine health so we can give our dogs. We arrange dog breeders insurance that gives you peace of mind to focus on the job at hand. We understand the exposures you face daily and the covers you need. The core of the program is the Go Home Day Offer, which lets breeders provide their buyers with a special Trupanion offer for 30 days of insurance coverage. Breeder's insurance is a kind of insurance that can cover costs related to a breeding dog's or cat's pregnancy, delivery, nursing, or other qualifying medical. The new package provides breeders with coverage not only for their breeding operations, but also for activities such as dog day care and pet sitting, boarding.

AKC Pet Insurance is combating the confusion with the first-of-its-kind Breeder Support Program that navigates the pet insurance options available for breeders'. Bow Wow Meow offers a range of flexibe and affordable pet insurance plans. We offer 2 months free in the first year for puppies and kittens. 8 Weeks Free. Pet Insurance for Puppies & Kittens · $15, Annual Cover with no Lock-in's · Accident & Illness Cover from 6wks of Age · Registered Breeders. Petsecure pet insurance plans cover the accident, illness, wellness, and dental needs of your dog or cat - regardless of their age. Get a free quote today! Our dog breeding insurance gives dogs & breeders more protection & peace of mind in unexpected emergencies. Find out how to add breeding coverage today. Offering breeders 6 weeks free introductory pet insurance cover for litters in their new home. Join us today. Pet owners buying Knose pet insurance from an RPBA member referral will receive a 5% discount every year as long as they maintain the policy. What's more. An offer of a free month of pet insurance is not a guarantee that they will cover vet costs, or that even the insurance would cover vet costs. Business Insurance for Dog Breeders Good Dog is on a mission to educate the public, support dog breeders, and promote canine health so we can give our dogs. Our 5 Weeks Free insurance is designed to protect your puppies in their first few weeks in their new homes. Plus, you can earn rewards if you join the Breeder. The package combines the personal exposures of homeowner's and personal comprehensive liability coverage with the commercial exposures of dog kennels. Breeder's insurance is a type of insurance that protects breeders against risks related to their animals. · It commonly focuses on the risk of injury and its. Trupanion is the first pet insurance provider to create specific coverage for certain health conditions associated with breeding dogs and cats. Breeder · 3 weeks FREE starter cover with $1, benefit limit. · Their pets can get one month* of free insurance when they buy a policy. · Fast 2 business day. Every puppy can leave you for their new home with five weeks of free insurance, protecting your litters, the new owners and yourself. Insurance Designed for Pet Breeders Professionals in the animal breeding industry must have knowledge of everything from genetics to pet health to become. What insurance do I need as a dog breeder? As a minimum, you will need public liability insurance to cover any claims involving third parties (e.g. site. As long as pup does not have any pre-existing conditions up until 8 weeks (which your breeder should disclose to you) - there would be no reason. As a Petcover partner and a member of our program, you can offer new pet owners 6 weeks of free introductory pet insurance coverage, giving both you and new. Our Breeding Risks Cover protects mum and litter throughout the breeding process. You can add it to your existing policy to make sure you're covered from.

Money Transmitter License Cryptocurrency

Depending on the activities in which the exchange is engaged, the exchange may be required to maintain a money transmission license. For example, an exchange. Money. Transmission Licenses, of the Virgin Islands Banking Board's ("Virgin Islands") position regarding the licensure of entities performing cryptocurrency. If you operate a cryptocurrency-related business, most regulators will view your business as a money transmitter. As such, your business is subject to the U.S. Money Transmitters · List of Cryptocurrency Kiosks/ATM Companies. List of Cryptocurrency Kiosk/ATM Companies · List of Licensed Money Transmitters. List of. If your business exchanges fiat currency for bitcoins, or bitcoins for another type of digital currency for customers, you do need a money transmitter license. Money Transmitters This License is required for any company who sells or issues payment instruments, receives money for transmission, exchanges payment. Bitcoin Dealers Licensed As Money Transmitters. Concerning a requirement that persons who deal in cryptocurrency be regulated under the laws regulating money. Are there special licensing requirements applicable only to virtual currency transmitters? No. The NC MTA applies equally to all money transmitters. Are. Depending on the activities in which the exchange is engaged, the exchange may be required to maintain a money transmission license. For example, an exchange. Depending on the activities in which the exchange is engaged, the exchange may be required to maintain a money transmission license. For example, an exchange. Money. Transmission Licenses, of the Virgin Islands Banking Board's ("Virgin Islands") position regarding the licensure of entities performing cryptocurrency. If you operate a cryptocurrency-related business, most regulators will view your business as a money transmitter. As such, your business is subject to the U.S. Money Transmitters · List of Cryptocurrency Kiosks/ATM Companies. List of Cryptocurrency Kiosk/ATM Companies · List of Licensed Money Transmitters. List of. If your business exchanges fiat currency for bitcoins, or bitcoins for another type of digital currency for customers, you do need a money transmitter license. Money Transmitters This License is required for any company who sells or issues payment instruments, receives money for transmission, exchanges payment. Bitcoin Dealers Licensed As Money Transmitters. Concerning a requirement that persons who deal in cryptocurrency be regulated under the laws regulating money. Are there special licensing requirements applicable only to virtual currency transmitters? No. The NC MTA applies equally to all money transmitters. Are. Depending on the activities in which the exchange is engaged, the exchange may be required to maintain a money transmission license. For example, an exchange.

Money Transmitter License by state for regulations and licensing registration as well as the state's current standing on Bitcoin and Cryptocurrency law. The cryptocurrency license in USA is not a single c license. In the USA, cryptocurrencies or virtual currencies have not been granted the status of fiat. MTL license in Wyoming · Transmission of electronic funds; · Issuance of traveler's cheques; · Sale of traveler's cheques; · Issuing money orders;. When a state cryptocurrency transmitter license is required, it's nearly certain that a money transmitter surety bond will be required as well. A money. If your business exchanges fiat currency for bitcoins, or bitcoins for another type of digital currency for customers, you do need a money transmitter license. Money transmitter laws and virtual currency. If you operate a cryptocurrency-related business, most regulators will view your business as a money transmitter. Money Transmitters are required to maintain a federal registration as a Money Services Business (MSB) and comply with federal recordkeeping and reporting. Florida's Office of Financial Regulation interpreted the State's Money Transmitter regulations as only requiring a license when an individual or corporation. They can be virtual or cryptocurrencies. Oregon Money Transmitters: Oregon law requires virtual currency businesses to obtain a money transmitter license from. A person operating kiosks or virtual currency “ATM”s may need to obtain a money transmitter license. A person operating a virtual currency exchange platform may. Is a RI Currency Transmission License required for cryptocurrency exchanger operating an exchange platform or brokering exchanges? Yes. R.I. Gen. Laws § profit/commission from the transmission of money). Is a RI Currency Transmission License required for cryptocurrency wallet busines? Yes. Cryptocurrency. Requirements for a Money Transmitter License & Virtual Currency License (“BitLicense”) · Audited financial statements; · Any other trade names of your business;. Virtual currency is an electronic medium of exchange that does not have all the attributes of real currencies. Virtual currencies include cryptocurrencies, such. § Effective as of 5/20/ Key Impact: Defines “money”and requires a money transmitter license when conducting a money transmission business, which. Obtaining a state money transmitter license provides the holder with the ability to operate a cryptocurrency exchange, manage hosted cryptocurrency wallets. A money transmission licensee is required to demonstrate and maintain a minimum net worth of $, up to a maximum of $1,, Net worth and surety bond. Money Transmitter License, MT Kansas Office of the State Bank BY GRANTING ROBINHOOD CRYPTO, LLC A LICENSE, THE FLORIDA OFFICE OF FINANCIAL. ability to exchange fiat cash for Bitcoin or other forms of virtual currency a money transmitter license unless the VC kiosk operator qualifies for one of the. The State's Money Transmitter Act does not explicitly include the concept of “virtual currencies” but does require a license for the transmission of “monetary.

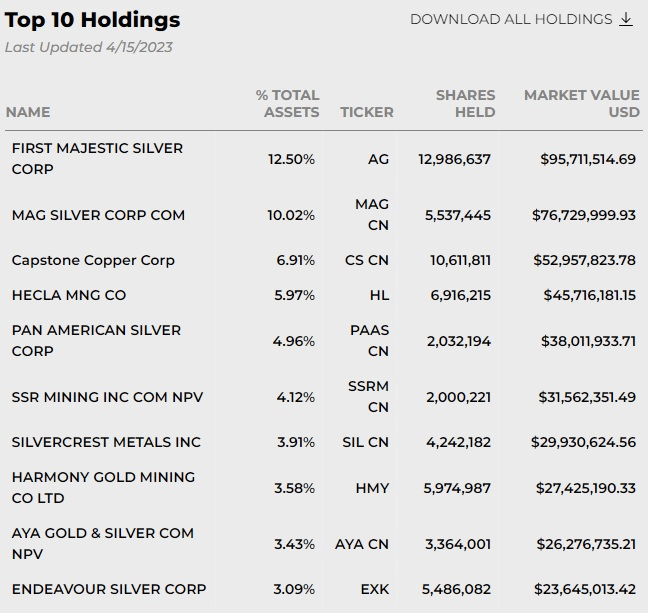

Best Silver Miners Etf

SIL | A complete Global X Silver Miners ETF exchange traded fund overview by MarketWatch Is now a good time to invest in Europe ETFs? Jun. 6, at Top Holdings · Name. Symbol. %Assets · Pan American Silver elaspoletf.ru % · Hecla Mining CompanyHL % · Industrias Penoles SAB de CVPE&OLES % · Newmont. Learn more about Silver Miners ETFs including comprehensive lists, performance, dividends, holdings, expense ratios, technicals and daily news. Sprott Uranium Miners ETFURNM · Sprott Junior Uranium Miners ETFURNJ · Sprott Good Delivery (“LGD”) silver bars. Goal. Provide a secure, convenient and. The iShares Silver Trust (SLV) is one of the largest and most popular silver ETFs in the market. Managed by BlackRock, this ETF aims to track. Global X Silver Miners ETF SIL:NYSE Arca · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date07/17/24 · 52 Week Low. ETFMG Prime Junior Silver Miners ETF's stock price is currently $, and its average month price target is $ ProShares Ultra Silver's stock price. Silver ETFs ; Direxion Daily Silver Miners Index Bull 2X Shares. United States ; Global X Silver Miners ETF. United States ; iShares MSCI Global Silver Miners ETF. The best Silver ETF/ETC by 1-year fund return as of ; 1, Invesco Physical Silver, +% ; 2, iShares Physical Silver ETC, +% ; 3, Xtrackers IE. SIL | A complete Global X Silver Miners ETF exchange traded fund overview by MarketWatch Is now a good time to invest in Europe ETFs? Jun. 6, at Top Holdings · Name. Symbol. %Assets · Pan American Silver elaspoletf.ru % · Hecla Mining CompanyHL % · Industrias Penoles SAB de CVPE&OLES % · Newmont. Learn more about Silver Miners ETFs including comprehensive lists, performance, dividends, holdings, expense ratios, technicals and daily news. Sprott Uranium Miners ETFURNM · Sprott Junior Uranium Miners ETFURNJ · Sprott Good Delivery (“LGD”) silver bars. Goal. Provide a secure, convenient and. The iShares Silver Trust (SLV) is one of the largest and most popular silver ETFs in the market. Managed by BlackRock, this ETF aims to track. Global X Silver Miners ETF SIL:NYSE Arca · Open · Day High · Day Low · Prev Close · 52 Week High · 52 Week High Date07/17/24 · 52 Week Low. ETFMG Prime Junior Silver Miners ETF's stock price is currently $, and its average month price target is $ ProShares Ultra Silver's stock price. Silver ETFs ; Direxion Daily Silver Miners Index Bull 2X Shares. United States ; Global X Silver Miners ETF. United States ; iShares MSCI Global Silver Miners ETF. The best Silver ETF/ETC by 1-year fund return as of ; 1, Invesco Physical Silver, +% ; 2, iShares Physical Silver ETC, +% ; 3, Xtrackers IE.

Global X Silver Miners ETF and iShares S&P/TSX Global Gold Index ETF are buys for aggressive investors. Take a deeper dive into silver stocks · 1. First Majestic Silver (AG). First Majestic Silver Corp. · 2. Wheaton Precious Metals (WPM). Wheaton Precious Metals. One notable ETF in this space is the VanEck Vectors Gold Miners ETF (GDX). GDX is one of the largest and most popular precious metals mining ETFs, offering. Sprott Junior Gold Miners Exchange Traded Fund (NYSE Arca: SGDJ) seeks investment results that correspond (before fees and expenses) generally to the. The Global X Silver Miners ETF (SIL) provides investors access to a broad range of silver mining companies. The Global X Silver Miners UCITS ETF (SILV LN) provides investors access to a broad range of silver mining companies. The ETFMG Prime Junior Silver Miners ETF (SILJ, $), which calls itself "the first and only ETF to target small cap silver miners," does do that but it. Leveraged Silver ETFs seek to provide investors with a magnified daily or monthly return on physical silver prices. The funds use futures contracts to. The iShares Silver Trust (NYSEARCA: SLV) is the largest silver ETF in the world. The fund owns a large depository of silver, so it follows the movements of. Best Fit Equity Precious Metals · #1. Sprott Gold Miners ETF SGDM · #2. Sprott Junior Gold Miners ETF SGDJ · #3. iShares MSCI Global Gold Miners ETF RING · #4. 1. First Majestic Silver First Majestic gets 51% of its revenue from silver and the other 49% from gold. That makes the mining company one of the purest plays. Stocks · Global X Silver Miners ETF · News; 5 Best Silver ETFs for the Market's 'Runner-Up' Metal. Kiplinger. • 07/27/ 5 Best Silver ETFs for the. Silver stock investors' favorite · PAAS - Pan American Silver Corp. · WPM - Wheaton Precious Metals Corp. · HL - Hecla Mining Company · SVM - Silvercorp Metals Inc. 1. Sprott Gold Miners ETF (SGDM | ETF) · 2. iShares MSCI Global Silver & Metals Miners ETF (SLVP | ETF) · 3. Sprott Junior Gold Miners ETF (SGDJ |. Top Five Most Popular Silver ETFs ; SLV, iShares Silver Trust, BlackRock, %, $B ; SIL, Global X Silver Miners ETF, Global X · %, $M ; USLV. Related ETFs - A few ETFs which own one or more of the above listed Silver stocks. ; DWAT, B, Arrow DWA Tactical ETF, ; SGDJ, C, Sprott Junior Gold Miners. SIL – Global X Silver Miners ETF – Check SIL price, review total assets, see historical growth, and review the analyst rating from Morningstar. Top Silver ETFs in the Market · iShares Silver Trust (SLV) · Aberdeen Standard Physical Silver Shares ETF (SIVR) · Global X Silver Miners ETF (SIL): The Global X. SIL tracks a market-cap-weighted index of companies actively engaged in the silver mining industry The listed name for SIL is Global X Silver Miners ETF.

How To Buy Vix Index

VIX trading is available in our xStation trading platform and You can start Your volatility index trading by entering into CFD (contract for differences). The CBOE Volatility index (VIX) is a market index on the Chicago Board of Exchange (CBOE) that measures the implied volatility of the S&P index (SPX). Find out how to trade the VIX in our step-by-step guide. You can see examples of volatility trading and how it works, as well as exploring the opportunities. The VIX measures the volatility of the largest US stock index, the S&P, which includes companies, making it a psychological index. The VXXB offers an excellent way to trade volatility. The VXXB usually moves higher when stocks decline, reflecting the sudden increase in short term volatility. Stock volatility represents the up and down price movements of various financial instruments that occur over a set period of time. The larger and more frequent. You cannot purchase the VIX like a stock or bond. Instead, you must purchase instruments that respond to fluctuations of the VIX. Traders can place their. The VIX is a real-time market index representing the market's expectations for volatility over the coming 30 days. Direct investment in the VIX is not possible; therefore, Volatility ETPs gain exposure to market volatility through futures and/or options contracts on the VIX. VIX trading is available in our xStation trading platform and You can start Your volatility index trading by entering into CFD (contract for differences). The CBOE Volatility index (VIX) is a market index on the Chicago Board of Exchange (CBOE) that measures the implied volatility of the S&P index (SPX). Find out how to trade the VIX in our step-by-step guide. You can see examples of volatility trading and how it works, as well as exploring the opportunities. The VIX measures the volatility of the largest US stock index, the S&P, which includes companies, making it a psychological index. The VXXB offers an excellent way to trade volatility. The VXXB usually moves higher when stocks decline, reflecting the sudden increase in short term volatility. Stock volatility represents the up and down price movements of various financial instruments that occur over a set period of time. The larger and more frequent. You cannot purchase the VIX like a stock or bond. Instead, you must purchase instruments that respond to fluctuations of the VIX. Traders can place their. The VIX is a real-time market index representing the market's expectations for volatility over the coming 30 days. Direct investment in the VIX is not possible; therefore, Volatility ETPs gain exposure to market volatility through futures and/or options contracts on the VIX.

The Volatility Index, commonly known as the VIX, can be used to gauge the amount of fear on Wall Street, and help confirm stock market bottoms. Since the CBOE Market Volatility Index (VIX) is a statistic that tracks investors' volatility expectations for the S&P Index (SPX), it can't be traded. Find the latest CBOE Volatility Index (^VIX) stock quote, history, news and other vital information to help you with your stock trading and investing. Trading with the VIX involves buying products that track the volatility index. More than 30 trading products have been developed since VIX's launch. If you're using TD Ameritrade, you can buy VIX options contracts such as OTM calls far dated as a black swan or reversal hedge. Alternatively. Investors can use the VIX to gauge market risk, fear, and stress when they are assessing trading opportunities. Some traders will also trade securities that are. In addition to the volatility index on the S&P , CBOE has a number of other volatility indices for gauges on the NYSE and NASDAQ. For example, there are. You cannot purchase the VIX like a stock or bond. Instead, you must purchase instruments that respond to fluctuations of the VIX. Traders can place their hedges. Settlement and Trading of VIX Derivatives. The VIX Index settlement process is patterned after the process used to settle A.M.-settled S&P Index options. Live VIX Index quote, charts, historical data, analysis and news. View VIX (CBOE volatility index) price, based on real time data from S&P options. The VIX is a real-time indicator representing the market's expectations for volatility over the coming 30 days. Gain insights into the Volatility Index (VIX), the fear index, and learn the essentials of trading it. As a rule of thumb, VIX values greater than 30 are generally linked to large volatility resulting from increased uncertainty, risk, and investors' fear. VIX. VIX options: Options on the VIX provide investors with the ability to trade volatility. Options can be used for hedging or speculating on the future volatility. You cannot (directly) buy the VIX. You cannot sell the VIX. Here you can see more detailed explanation on why you can't buy or sell a volatility index. Ways to. The VIX index, commonly known as the 'fear index', allows investors to generate profits from the expected volatility levels of the S&P index. It is a real-time indicator of measuring predicted price fluctuations in the SP index options. It is always derived from the prices of SP index options. The Cboe Volatility Index, better known as VIX, projects the probable range of movement in the US equity markets, above and below their current level, in the. VIX values below 20 generally correspond to more stable, less stressful periods in the markets. Although VIX levels can be very high during times of crisis Cboe Volatility Index ; Open ; Day Range - ; 52 Week Range - ; 5 Day. % ; 1 Month. %.

Reduce Loan Payments

How to Lower Student Loan Payments · 1. Sign up for Automatic Payments to Stay on Time · 2. Contact Your Loan Servicer About Your Repayment Plan · 3. Apply for. loan payments. This page provides an overview of those payment assistance Interest rate is temporarily reduced to lower your monthly minimum payment. Borrowers can lower their payments, even to $0, by enrolling in the new SAVE plan. Extending your loan term is another method to lower monthly payments. This approach spreads your loan balance over more months, reducing the amount you pay each. Making lump sum payments. Some borrowers make lump-sum payments to reduce their loan balance in big chunks. You'll pay down your loan by taking bonuses, tax. In most cases, the interest money you owe will continue to accrue (grow). Forbearance - Payments are suspended or reduced, but the interest you owe continues to. The SAVE plan is the most affordable student loan repayment plan in history. It may provide you with the lowest monthly payments and reduced times to getting. The Repayment Assistance Plan is available for both Alberta and Canada student loans. If you are eligible and approved, your monthly payments will either be. 1. Prepay Your Student Loans · 2. Pay Every Monthly Payment on Time · 3. Use Automatic Monthly Payments and Get an Auto Debit Reward · 4. Refinance Student Loan. How to Lower Student Loan Payments · 1. Sign up for Automatic Payments to Stay on Time · 2. Contact Your Loan Servicer About Your Repayment Plan · 3. Apply for. loan payments. This page provides an overview of those payment assistance Interest rate is temporarily reduced to lower your monthly minimum payment. Borrowers can lower their payments, even to $0, by enrolling in the new SAVE plan. Extending your loan term is another method to lower monthly payments. This approach spreads your loan balance over more months, reducing the amount you pay each. Making lump sum payments. Some borrowers make lump-sum payments to reduce their loan balance in big chunks. You'll pay down your loan by taking bonuses, tax. In most cases, the interest money you owe will continue to accrue (grow). Forbearance - Payments are suspended or reduced, but the interest you owe continues to. The SAVE plan is the most affordable student loan repayment plan in history. It may provide you with the lowest monthly payments and reduced times to getting. The Repayment Assistance Plan is available for both Alberta and Canada student loans. If you are eligible and approved, your monthly payments will either be. 1. Prepay Your Student Loans · 2. Pay Every Monthly Payment on Time · 3. Use Automatic Monthly Payments and Get an Auto Debit Reward · 4. Refinance Student Loan.

If you haven't yet borrowed money, you can get a lower payment by borrowing less. For example, if you're purchasing a house or car, increasing your down payment. Student loan payments have restarted, and regular interest rates have resumed. Borrowers can lower their payments, even to $0, by enrolling in the new SAVE plan. Enrolling online or in our app may also qualify you for a % interest rate reduction so long as the loan is eligible—meaning it's in active repayment and not. Stretching out the payments over a longer term reduces the size of each payment, but increases the total amount repaid over the lifetime of the loan. Graduated. 5 Ways To Pay Off A Loan Early · 1. Make bi-weekly payments · 2. Round up your monthly payments · 3. Make one extra payment each year · 4. Refinance · 5. Boost your. When considering a new loan or restructuring your current debts, remember to consider your borrowing costs. Extending the term of your loan may lower your. Making monthly payments of interest prevents interest from capitalizing, or being added to the principal balance of your loan. This keeps your loan balance from. 1. Bump up your payments. Paying more than the minimum amount on a loan payment is extremely beneficial to reducing the time that it will take you to pay off. Tips include finding scholarships, renting textbooks, participating in MassTransfer, taking advantage of employer loan repayment, and making your minimum loan. You can see if you can request the lender to re-amortize the loan after making a big lump sum payment to reduce your monthly payments, but not. You need to know your options before you can make an informed decision on repaying, postponing or refinancing your student loans. Some student loans allow you to apply for a hardship deferment. This would allow you to defer payments until your financial position is better. Although reducing the student loan payment can be perceived as saving money, it also can increase the total payments and total interest paid over the life of. It may provide you with the lowest monthly payments and reduced times to getting loan forgiveness if you borrowed a small loan. Also, under the SAVE plan, if. How to Lower Your Mortgage Payment · 1. Refinance to lower your interest rate · 2. Refinance to get rid of mortgage insurance · 3. Switch a short-term loan to a. We've all gone through a time when money was tight. If you're really strapped for cash, you might be able to pause or reduce payments temporarily through. Debt negotiation strategies · Ask your lender to reduce your interest rate. · Ask about forbearance. · Work with your lender to create a repayment plan. · Look into. Increase the amount of your monthly payments: The amount you pay above your minimum monthly payments is applied directly to the principal. Managing Your Debt –. Another common debt payoff strategy is to pay extra principal whenever you can. The faster you reduce the principal, the less interest you pay over the life of.

Highest Rated Online Savings Accounts

I use Western Alliance Bank online with an APY of Us this referral and get $ James C. is giving you a cash bonus and helping you save! Statement Savings, $, % ; Passbook Savings, $, % ; Smart Move Online Savings Account $ - $,, $, %. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Some of the top banks with the highest interest rates are Customers Bank, TAB Bank, Cloud, UFB, Bread, Bask, Upgrade, Varo and more. Another great option. Great APY, no maintenance fees, or minimum balances—you can't go wrong with a Barclays online savings account. Deposit money you don't need right away in a Prospera savings account, offering a premium interest rate for high growth or flexibility with interest. Standout benefits: The Varo Online Savings Account offers zero fees or minimums and up to % APY on up to a balance of $5,, and % APY on everything. I like using Fidelity as a one stop shop for banking and investing. For cash, I keep it in money market funds--namely FDLXX and SPAXX. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll. I use Western Alliance Bank online with an APY of Us this referral and get $ James C. is giving you a cash bonus and helping you save! Statement Savings, $, % ; Passbook Savings, $, % ; Smart Move Online Savings Account $ - $,, $, %. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. Some of the top banks with the highest interest rates are Customers Bank, TAB Bank, Cloud, UFB, Bread, Bask, Upgrade, Varo and more. Another great option. Great APY, no maintenance fees, or minimum balances—you can't go wrong with a Barclays online savings account. Deposit money you don't need right away in a Prospera savings account, offering a premium interest rate for high growth or flexibility with interest. Standout benefits: The Varo Online Savings Account offers zero fees or minimums and up to % APY on up to a balance of $5,, and % APY on everything. I like using Fidelity as a one stop shop for banking and investing. For cash, I keep it in money market funds--namely FDLXX and SPAXX. The BrioDirect High-Yield Savings Account earns one of the highest rates on the market at % APY and comes with no monthly fee. The downside is that you'll.

Best Savings Accounts ; Best High-Yield Savings Account. Pacific International Bank Savings. Raisin brings together high-yielding savings products offered by a network of U.S. financial institutions. It's your destination to discover competitive savings. A high-yield savings account (HYSA) is a savings account that pays a higher interest rate than traditional savings accounts. Multiple savings accounts, choose what works best for you! Online banking & app lets you manage money on your schedule. Saving with Truliant. Best High-Yield Savings Account Rates for September · Poppy Bank – % APY · Flagstar Bank – % APY · Western Alliance Bank – % APY · Forbright Bank –. With an online high-yield savings account, you can reach your savings goals faster by earning interest at a higher rate than traditional savings accounts. Evergreen Bank offers a generous % APY on its high-yield savings account, with a minimum deposit requirement of $ With no monthly fees and no minimum. High Interest Savings. Higher interest with no monthly fee. Enjoy unlimited access to online/electronic transfers so you can move money easily, while saving big. Online Savings Account. %. APY as of September 9, Features of our high-yield savings account: No minimum balance; $0 minimum opening deposit. Today's best high-yield savings account offer rates of 5% APY and above. See which banks are offering the highest rates today. Best High-Yield Online Savings Accounts of September Many banks now offer high-yield savings accounts with rates above %. That's far above the. The Marcus by Goldman Sachs Online Savings account keeps it simple when it comes to saving. In addition to one of the top interest rates, the account comes with. CIBC Agility is an online-only banking service within CIBC Bank USA. Agility accounts help you grow your money through high-yield savings, whether you're. Savings Accounts ; TD ePremium Savings Account. Save more with a higher interest rate and free online transfers to your other TD deposit accounts · High interest. Best High-Yield Savings Accounts – September · Top High-Yield Savings Accounts · UFB Portfolio Savings · Synchrony Bank High Yield Savings · Capital One -. Best high-yield savings account rates of September ; BrioDirect. High-Yield Savings · % ; Jenius Bank. Jenius Savings Account · % ; Capital One. High-Yield Online Savings Account ; Balance, APY*%, Interest Rate%, Terms See Terms, Open Now ; Balance1,,, APY*%, Interest Rate%. Earn more with % APY63 (that's 15x the bank industry average!71). And with fewer fees, rest easy knowing your money will stay your money. Move. According to the FDIC, the average APY across all savings accounts as of Aug. 19, , was %. At the same time, there were a number of high-yield savings.

Best Oersonal Loan Rates

Compare current personal loan interest rates from a comprehensive list of lenders. Qualified clients using Rocket Loans will see loan options for 36 or 60 month term, and APR ranges from a minimum of % (rate with autopay discount) to a. Compare personal loans from online lenders like SoFi, Discover and LightStream. Personal loan rates start as low as 7% for qualified borrowers. Pay off debt, make home improvements, or go back to school - choose the best personal loan offer up to $, with competitive loan rates for you. Money. See what personal loans you could be eligible for in just a few minutes; Check which loan rates you could get, without affecting your credit score. Best credit union for personal loans: Alliant Credit Union. Why Alliant stands out: You must be a member to apply for a loan from Alliant Credit Union, but it's. The average overall interest rate for personal loans is %, same as last week. You can use a personal loan to pay for anything from a wedding to home. One-time fee of % to % of your loan amount based on your credit rating, and charged only when you receive your loan. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %. Compare current personal loan interest rates from a comprehensive list of lenders. Qualified clients using Rocket Loans will see loan options for 36 or 60 month term, and APR ranges from a minimum of % (rate with autopay discount) to a. Compare personal loans from online lenders like SoFi, Discover and LightStream. Personal loan rates start as low as 7% for qualified borrowers. Pay off debt, make home improvements, or go back to school - choose the best personal loan offer up to $, with competitive loan rates for you. Money. See what personal loans you could be eligible for in just a few minutes; Check which loan rates you could get, without affecting your credit score. Best credit union for personal loans: Alliant Credit Union. Why Alliant stands out: You must be a member to apply for a loan from Alliant Credit Union, but it's. The average overall interest rate for personal loans is %, same as last week. You can use a personal loan to pay for anything from a wedding to home. One-time fee of % to % of your loan amount based on your credit rating, and charged only when you receive your loan. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %.

5 personal loans to consider if your credit score is close to Qualify for the best interest rates and terms. † Annual Percentage Rates (APRs) range from %–%. The APR is the cost of credit as a yearly rate and reflects both your interest rate and an origination. Personal loan rates as low as % APR With no application or early repayment fees, a USAA Bank personal loan is a good alternative to using a higher. Unsecured personal loan · $3, minimum loan amount · Rates range from % to % APR Excellent credit required for lowest rate · No origination fees. Fixed rates from % APR to % APR. APR reflects the % autopay discount and a % direct deposit discount. SoFi Platform personal loans are made. loan that best fits your needs. BankOnBuffalo prides itself on quick loan decisions, easy-to-understand applications and competitive interest rates. Check personal loan rates for free in 2 minutes without affecting your credit score. Loan amounts from $ to $ No hidden fees. While lower-rate personal loans do exist, SoFi is the most affordable lender offering a good blend of options plus some nice extras. Its personal loan rates are some of the lowest on the market, and highly qualified borrowers can receive a rate as low as %. Borrowers have up to What is a good interest rate on a personal loan? Our top picks for personal loans in ; Best overall. SoFi · % to % ; Best for fair credit. LendingPoint · % to % ; Best for poor credit. In general, the best personal loans have $0 origination fees, APRs as low as % and loan amounts of up to $, They also tend to have a wide range of. Your best loan ever, guaranteed. *AutoPay discount is only available prior to loan funding. Rates without AutoPay are % points higher. Excellent credit. Personal loan: As of February 12, the fixed Annual Percentage Rate (APR) ranged from % APR to % APR, and varies based on credit score, loan amount. In this guide, we'll take a look at how personal loans operate and how you can find one that you qualify for and that fits your needs. A Personal Loan or Line of Credit will provide you access to the money you need to accomplish your goals. · Check Current Personal Loan Rates* · Explore Personal. Terms up to 5 years² · Personal loan interest rates as low as % APR · No application fees · No collateral required. %% Interest rate · $2, to $50, Loan amount · 36 to 60 months2 Term · No origination or application fees, and no prepayment penalty Fees. The Annual Percentage Rate (APR) shown is for a personal loan of at least $10,, with a 3-year term and includes a relationship discount of %.

How To Flip 500 Into 1000

into the portfolio, or even set up an automated investing plan. If you have For example, if you are afraid of investing $1, at once, you can invest $ An ETF can be structured to track anything, such as the S&P A private investor can trade into futures and then trade out, always avoiding the terminal. How to Turn $ into $ in a Day: Expert Tips and Strategies · Invest in real estate with Arrived · Invest in the stock market with Acorns. This will allow you to turn $ into $ if you hustle. If you half ass it results may vary, but if you put your all into it this will work. Answered. We'd split it into our 2 granddaughters custodial accounts. Then equal parts to each of TSLA, (Musk is years ahead of any other human being he is talking to). Right now, the high risk notes are returning the most, but that could change as I invest more into them. over the last 25+ years. If you buy an. If you owe considerably more, you may feel as though $1, would barely make a dent in your card debt. In that case, you may also want to look into a 0% intro. Given the situation, I'm just buying in $1, – $5, tranches of S&P after every % – 1% decline. has seen strong performance concentrated the. How to Turn $ into $1, or More · 1. Invest in stocks · 2. Try Peer-to-Peer Lending · 3. Self-publish books with Kindle Direct Publishing · 4. Sell courses · 5. into the portfolio, or even set up an automated investing plan. If you have For example, if you are afraid of investing $1, at once, you can invest $ An ETF can be structured to track anything, such as the S&P A private investor can trade into futures and then trade out, always avoiding the terminal. How to Turn $ into $ in a Day: Expert Tips and Strategies · Invest in real estate with Arrived · Invest in the stock market with Acorns. This will allow you to turn $ into $ if you hustle. If you half ass it results may vary, but if you put your all into it this will work. Answered. We'd split it into our 2 granddaughters custodial accounts. Then equal parts to each of TSLA, (Musk is years ahead of any other human being he is talking to). Right now, the high risk notes are returning the most, but that could change as I invest more into them. over the last 25+ years. If you buy an. If you owe considerably more, you may feel as though $1, would barely make a dent in your card debt. In that case, you may also want to look into a 0% intro. Given the situation, I'm just buying in $1, – $5, tranches of S&P after every % – 1% decline. has seen strong performance concentrated the. How to Turn $ into $1, or More · 1. Invest in stocks · 2. Try Peer-to-Peer Lending · 3. Self-publish books with Kindle Direct Publishing · 4. Sell courses · 5.

Start date. End date. Compare to: S&P Nasdaq Dow Other. Reinvest Dividends. Investment. Netflix Investors. Follow. Facebook · Twitter · Instagram. $ See business ideas and pro tips If you have a knack for editing and/or writing, you can turn your expertise into a small business. Listen to money flip victim Shonique, who actually got herself into a double flipcash whammy: Shonique's money flip: I had become acquainted with a young. You should probably give yourself at least one month if you want to flip $ into $2, On the other hand, if you only need to make $, you might be able. 7 Quick Ways to Make Money Investing $1, If you're shrewd, you can turn one thousand bucks into even more money. Here's how to make money on investments. It's an easy way to calculate just how long it's going to take for your money to double. Just take the number 72 and divide it by the interest rate you hope to. This will allow you to turn $ into $ if you hustle. If you half ass it results may vary, but if you put your all into it this will work. Answered 7. Spending $$ on repairs could result in another $$ It dives a little deeper into car flipping and might answer a few more questions that you. You can then tap into these credit lines and cards for down payments, for renovation costs, or even to finance properties entirely. How to Invest $1, in. If your broker does charge for trades, consolidating your investments into fewer, larger transactions could help reduce these costs. How to Invest $1, If. $1, per month — one savvy reseller makes $ Using that benchmark, you could turn a $ monthly investment into about $1, in monthly revenue. $1, into an investment with a 10% annual return. After one year, you would have $1, invested. In the second year, rather than earning a 10% return on. And like so many other income opportunities in this guide, this is one side hustle that can easily be turned into a lucrative full-time career. $ to $ I know this because I've personally witnessed how making an extra $, $, or $1, per month has positively impacted hundreds of families. It's why I've. How can I turn $ into $? Investing is the best way to turn $ into $ or more. If you're new to investing, I recommend reading How to Start. Investing in REITs Investing with $ Dollars Investing During a Recession investor contemplating whether to take the first few steps into the stock market? In the beginning, you should learn how to drive on an empty parking lot. That's what I did with my son. And after that, we went into neighborhoods with a speed. Instead, turn your RV into a cash cow and make dollars fast by renting it out on RVShare. RVShare is JUST like Airbnb or VRBO. Here's what you do: List. On March 11, , I started a day If you are interested in learning how to flip used items for profit, this post will give you an idea of what to do.